Без рубрики

How Usually Education loan Forgiveness Affect the Real estate market?

- Punctual products to the financing forgiveness

- Just how financial obligation, forgiveness, plus the housing market is associated

- Certain housing marketplace alter – what to expect?

- Cautious optimism to own homeowners

In the future, software commonly offered to forgive around $20,000 out of beginner debt for each and every borrower. It is a striking package, and something which is determined far speculation regarding how it will effect this new wide savings.

Homeowners, especially assets traders, are definitely seeing. Over 40 mil some body bring beginner financial obligation, 2nd simply to home loan debt. Exactly what are the basic affects off altering unnecessary man’s monetary position along these lines – and exactly how does it affect the housing industry?

Certain property owners is eagerly looking forward to a rush off newly obligations-free customers, while others you’ll find it just like the an unjustifiable pricing, not worthy of its likely advantageous assets to the latest economy.

It is an intricate matter, but let’s just be sure to unpack they. Just how is education loan forgiveness plus the housing industry related?

Timely items toward financing forgiveness

Already, new Biden administration intentions to forgive as much as $ten,000 out-of scholar debt for each and every borrower, or over to $20,000 to possess Pell Offer readers. Mortgage forgiveness would be accessible to consumers whoever annual income is actually not as much as $125,000.

In the usa, a lot of people with student loans are obligated to pay to $twenty five,000. Because of the various quotes, forgiveness away from $ten,000 do totally delete the debt from 33% to help you fifty% ones individuals.

And there is way more towards the bundle than canceling financial obligation. As a result of the, income-created fees conditions, individuals with finance kept immediately after forgiveness will see their payment cut-in 50 % of.

Low-money houses stand-to work for the most out of education loan forgiveness. Lots of loans in No Name Pell Give receiver are from property making less than $60,000, and therefore are much more likely to be Black, Latina or Native.

To one another, these tips feel the ability to free up a great amount regarding discretionary money – particularly for Millennials, Gen Z, and people out-of colour, exactly who manufactured the most significant proportion away from Pell Offer recipients.

Exactly how personal debt, forgiveness, additionally the housing market is actually related

Education loan loans can impact each other qualifiers. In fact, scholar personal debt is one of the most aren’t cited points that keep some one back regarding to get their earliest house.

Monthly mortgage payments is consume throw away income, so it is more difficult to store upwards to possess a down payment. Loan providers think about applicants’ debt burden in relation to all of them having a home loan, with higher finance absolutely holding straight back what they are able to be considered getting.

Eliminating or cutting you to debt weight you will definitely allow borrowers to keep additional money getting an advance payment, along with enhance their purchasing energy and get accepted to have a much bigger financial.

In theory, that will release an influx out of eager buyers towards housing markets. One to improved request you will push home values higher, doing what exactly is called an excellent seller’s business.

Impending housing marketplace changes – what to anticipate?

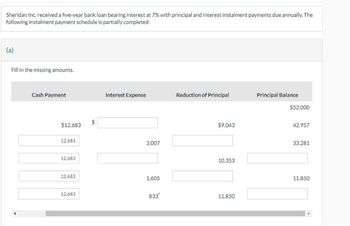

![]()

However in facts, naturally, everything is hardly easy. In practice, it’s unsure in the event the Biden’s plan would impact the homes atically – otherwise in reality, create an evident effect whatsoever.

First of all, need for property already outstrips also have in the a lot of new United Claims. Whenever you are however, places will vary of the region, really home owners commonly struggling to sell.

This particular fact is mirrored from the ascending issue of houses unaffordability in america, with over 50 % of Us americans great deal of thought a major problem for the the society.

Financial obligation cancellation plus cannot realistically translate into the fresh instantaneous capability to buy a property – at least perhaps not for almost all consumers.

Even in a solecircumstances situation, would-become homeowners will need time to conserve an advance payment for the recently freed-right up finance. That implies it might just take at the very least several to help you 18 months before this brand new influx regarding consumers hit the market.

Oftentimes, education loan forgiveness won’t actually end in a lot more spending money. Most loan money are frozen for the past a couple of age. Individuals have likely assigned that cash somewhere else, including to keep speed having ascending energy and you will shopping costs.

Neither are pupil personal debt the actual only real basis staying the buyers out for the ple, home loan rates of interest are sky-higher now – recently striking their highest since the 2008 overall economy.

Mindful optimism to own residents

Any changes in brand new housing market do take sometime to help you getting noticeable immediately following financing forgiveness was produced. If you find yourself there is the possibility so you’re able to release major request, used this type of effects would be minimal.

Precisely what does browse very specific would be the fact mortgage forgiveness cannot outright harm the new housing marketplace, particularly in energetic urban areas. You’ll find currently a number of customers in search of homes, and forgiveness would likely overload forces currently at the play, unlike transforming the actual property field entirely.

Based on your own region, residents will get choose for good hold off and see’ means, planning on an influx regarding demand off recently financial obligation-100 % free customers. In the meantime, renting your house is a savvy relocate of a lot segments, enabling citizens to generate passive money while you are their property rises in really worth. To own an in depth outline of a few when deciding whether or not to lease otherwise offer, listed below are some our e-guide.

If you’re seeking leasing your household, but unnerved by the point and effort one to gets into getting a property owner, check out Fall-in. We are a modern-day replacement for possessions government businesses, and make renting phenomenal having home owners and you will residents.

Afton Brazzoni has been a beneficial storyteller because youthfulness, when she authored her basic “book” in the horses in an effective hardcover laptop-from inside the pen. Now that have nearly 14 several years of sense just like the a professional journalist, their particular functions has been featured in various products all over United states and you may Europe. Once the a former journalist, Afton takes a journalistic method to performing original, expert-level stuff.