Без рубрики

Just how Home loan Collateral Performs; A comprehensive Publication

- David Cumberbatch Blogged:

In the wide world of Canadian a residential property and you can fund, understanding how mortgage security services is a must for anyone seeking pick assets otherwise re-finance current loans.

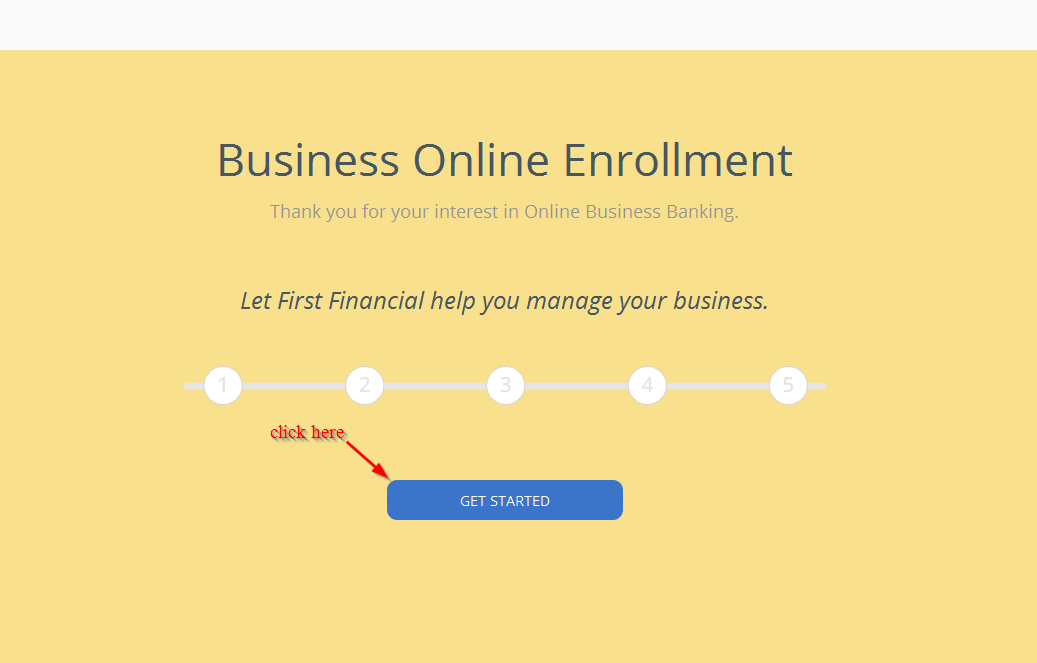

That it total publication will delve into the fresh new intricacies regarding collateral mortgage loans, dropping white on their processes, advantages, potential drawbacks, as well as how it compare to conventional mortgages. We’re going to also provide important tips for controlling your own guarantee home loan efficiently and offer one step-by-step self-help guide to making an application for that compliment of .

What exactly is a security Mortgage?

A guarantee mortgage is a type of financing protected against your property, on home itself helping since the equity investment.

In place of antique mortgages in which the loan amount will be based upon the new property’s very first cost, security mortgage loans succeed homeowners to gain access to a credit limit lay at the a share of your property’s appraised really worth, generally as much as 80% of one’s residence’s value .

One of the first benefits associated with equity mortgage loans is their flexibility. You can access fund doing your own approved borrowing limit instead needing to renegotiate home loan conditions, which makes them good for capital home home improvements, investments, and other large expenditures.

Likewise, guarantee mortgages usually have down interest rates compared to the instant approval bad credit installment loans checking account unsecured loans, leading them to a nice-looking option for people trying to sensible funding alternatives.

If you are collateral mortgages offer liberty and you will aggressive rates, there is also specific possible downsides to consider. For example, lenders can charge large costs to have starting an equity home loan than the traditional mortgages.

In addition, due to the fact financing try secured against the assets, consumers could possibly get deal with more strict lending conditions and you will risk dropping their house whenever they default towards loan.

How exactly to Be eligible for a guarantee Financial that have

Qualifying to possess an equity home loan pertains to fulfilling certain requirements, as well as having an acceptable credit rating, steady earnings, and you will property appraised within an esteem that meets brand new lender’s conditions. Our experienced financial gurus can be make suggestions from the software processes, working for you hold the money you prefer having aggressive conditions and pricing customized into the book condition.

Candidates are typically expected to keeps a specific credit history you to definitely matches the newest lender’s minimal conditions. A fair so you can good credit score reveals a track record of in control monetary behavior and you can suggests that you could pay off the newest home loan.

The house or property being used just like the security to help you secure your financial means to get appraised satisfactory into financial so you’re able to agree your financing. New assessment can be used to choose your loan-to-really worth proportion and you may shows important aspects of your house. Certified appraisers carry out an on-webpages check out that have a full inspection of interior and you can outside of your home.

Mortgage lenders generally speaking discover borrowers with a stable way to obtain earnings to be certain they could make monthly homeloan payment obligations consistently. Money avenues such as for example a position income, providers money, rental earnings and other credible sourced elements of money gamble an important area into the protecting the approval.

Comparing Security Mortgage loans so you can Old-fashioned Mortgage loans

When you compare collateral mortgages in order to antique mortgage loans, its required to believe things such as for example interest rates, costs, independence, and you will qualification standards. When you’re security mortgage loans give deeper liberty inside the accessing fund, they might have large configurations will cost you and more strict financing requirements as compared to old-fashioned mortgage loans. Fundamentally, the right choice depends on your financial wants and you can issues.

Traditional mortgage loans be a little more popular and do not stop you from delivering other money facing your property. A security financial can occasionally consume the complete property value their house, it is therefore difficult to be eligible for one additional refinancing regarding future.

It’s essential to measure the can cost you, terminology, and you may tool features of per home loan and you may imagine trying pointers off a mortgage elite to search for the ideal fit for your circumstances.