Без рубрики

Home loan Qualification: Techniques Getting Homebuyers Into the India

Have you been need to get your dream house within the Asia? Really, we realize one to buy a home isn’t any quick accomplishment, especially when you are looking at organizing profit. This is where lenders need to be considered an essential device to possess flipping your own homeownership hopes and dreams into the fact. But wait! First going to the detailed listings and you may envisioning the next nest, it is vital to see that essential element: mortgage qualifications. Don’t be concerned; we’ve got the back!

In this comprehensive guide particularly targeted at home buyers for the Asia, we’re going to take you step-by-step through everything you need to find out about evaluating their qualification to possess home financing. Very, let’s embark on this informing journey together and you will discover the door so you’re able to sensible financing choices that build same day loans Pleasant Groves AL running a piece of paradise simpler than ever before!

Buy your upcoming! Trust all of our educated people out of realtors so you’re able to build smart investments and you will build your riches.

What is Financial?

Home financing is actually that loan pulled by a single off a lending institution to get property. The home might be a home, apartment house, commercial or residential. The loan amount try paid at once which will be paid down over the years thanks to EMIs. Experts were income tax write-offs, versatile installment period, etc.

Home loan Qualification Criteria into the Asia

When you submit an application for a mortgage into the Asia, to begin with loan providers tend to check will be your qualifications. Eligibility criteria change from lender to lender, but there are a few preferred activities that every loan providers envision.

Loan providers contemplate the sort of assets you are buying, the cost capability, and intent behind the mortgage when assessing your qualifications.

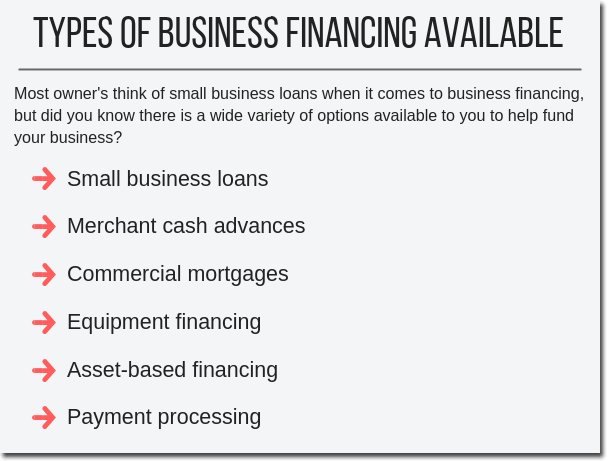

Form of Home loans Readily available

step one. House Get Financing: Such financing are accustomed to loans the acquisition out-of yet another house. Qualification conditions of these loans become income, a career background, credit score, and you will downpayment amount.

2. Domestic Framework Loans: These types of funds are widely used to money the construction out of a different household. Eligibility requirements for those funds are income, a position background, credit history, downpayment count, together with land value on what your house could well be depending.

step three. Do-it-yourself Finance: Such funds are acclimatized to finance solutions otherwise home improvements so you’re able to an enthusiastic present house. Eligibility conditions of these funds tend to be facts eg income, a position background, credit history, and equity yourself.

4. Domestic Security Fund: These types of finance are widely used to tap into brand new equity who’s started gathered from inside the a house. Qualifications criteria for those funds include activities eg credit score and you will security in the home.

5. Home loan Refinance Finance: These types of loans are acclimatized to re-finance an existing real estate loan within a lowered interest rate. Qualifications requirements of these finance include factors for example credit rating, a position history, and you may collateral in the home.

Data Had a need to Get home financing

Need a deep dive towards the information on many records needed for a home loan app from the training your site less than:

Advantages of Providing a home loan

step 1. You should buy a diminished interest: Mortgage brokers always come with straight down rates of interest than simply signature loans otherwise playing cards. This means you can save money on the entire price of the loan.

2. You can get an extended repayment several months: Mortgage brokers will often have lengthened repayment periods than other types of finance, you can dispersed the price of your loan over a longer period. This can help you afford your monthly payments.

step 3. You can use your home security to help you borrow cash: If you have equity of your home, it can be used just like the guarantee for a financial loan. As a result you might borrow money resistant to the worth of your residence, which is of use if you wish to generate an enormous purchase otherwise combine personal debt.