Без рубрики

Understanding the Difference between Jumbo vs. Conforming Financing

If you have been domestic hunting from inside the a higher-cost housing marketplace, you might was basically presented with a selection for a good jumbo loan-even if the home you are looking at are not jumbo-size of. That’s because the jumbo in jumbo funds is the sized the loan, perhaps not how big the house or property, and it is something you could possibly get consider if you would like borrow more than the conforming loan limitation towards you.

What is actually a conforming financing?

Compliant loans is actually fund one to meet, otherwise comply with, loan amount constraints put by a national service known as the Government Houses and Finance Institution (FHFA). In addition, they should meet with the financing direction lay by the Government National Financial Organization (Fannie mae) as well as the Government Home loan Financial Corporation (Freddie Mac computer). These tips are created to cover lenders of credit so you can borrowers whom, in writing, almost certainly won’t be able to expend back the loans. Nonetheless they protect borrowers out-of predatory credit programs of the ensuring it aren’t biting from over they are able to chew. Home loans you to fulfill these guidelines are straight down exposure for everyone inside it. Faster risk for loan providers generally speaking form being qualified direction try more comfortable for borrowers to meet up with.

What is actually an effective jumbo loan?

Jumbo finance are designed for large mortgage quantity you to meet or exceed conforming mortgage restrictions. Though you would need to fulfill certain qualifying requirements becoming accepted the mortgage, the specific economic criteria are far more rigid to own jumbo fund than conforming fund.

Jumbo money are offered for people credit extra money as compared to compliant loan maximum because of their city. It due to numerous explanations, and buying a house that have a high cost or in a premier-costs area, or whenever refinancing a current larger-balance financial. As the high money amounts slide outside the restrictions from compliant fund, they are not entitled to be purchased, guaranteed, or securitized by the Federal national mortgage association or Freddie Mac. Off a beneficial lender’s point of view, that renders jumbo fund an excellent riskier financing.

So you can counterbalance it additional chance, lenders need more encouragement from borrowers that they will find a way to spend back the mortgage. This means that, it indicates jumbo loans feature more strict qualifying assistance, for example high credit ratings, large off costs, even more property, and lower financial obligation-to-money ratios, as well as highest rates of interest.

Conforming against. jumbo mortgage limits

Really mortgage lenders will focus on https://paydayloansconnecticut.com/taylor-corners/ conforming financing while they was very liquids, simple to bundle market so you can people, and you can quickly free up more funds that can following be studied in order to point way more money. To attenuate sector volatility, lending limitations are ready of the authorities.

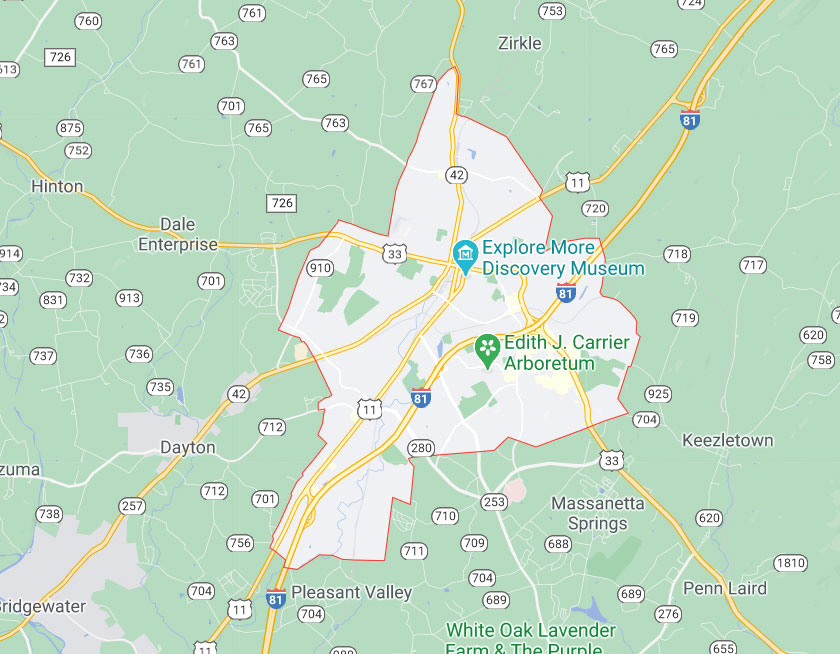

At the time of ounts are capped from the $548,250 to possess an individual-product domestic for the majority parts of the country. Yet not, since FHFA understands pricing can easily exceed so it when you look at the high-costs housing places, such as for instance Hawaii, Washington D.C., San francisco, otherwise Los angeles, restrict loan limits can be arrive at as high as $822,375 in more high priced portion. However, despite higher-cost areas, you can exceed those people limitations, and also make jumbo money a useful product.

Qualifying guidance to have conforming and jumbo finance

In the course of time, this is the size of the loan you want to to invest in one to will determine whether you are deciding on an effective jumbo mortgage otherwise an excellent conforming loan.

In case your financial amount is less than the required conforming financing limit for your county, you then should be eligible for a compliant financing provided your meet up with the lending requirements.

Yet not, in case the home loan usually go beyond a loan limitation, you will want an effective jumbo financing and must meet jumbo financing qualifying criteria. Jumbo loan providers put their particular underwriting assistance, so eligibility can differ from financial to help you bank, therefore it is more importantly to know this type of legislation.

After the afternoon…

Choosing anywhere between a compliant and you may a good jumbo mortgage merely boils down toward money means. If you find yourself lenders has novel standards per mortgage sorts of, you might contact us to get more on the the basic degree criteria having conforming and you will jumbo mortgages getting 2021.

In the event your mortgage is small or big, when you’re prepared to start with the borrowed funds processes, we can will bring you pre-recognized easily and you will talk about your options.