Без рубрики

Understanding on :House Guarantee Loan Credit score 580

The majority of people, immediately after gaining homeownership because the a primary economic milestone, believe taking right out property equity mortgage. You are able to the money having everything you want, also home improvements and you may debt consolidation reduction. You’re capable of getting a property Collateral Loan Credit Get 580 .Household equity money allow property owners to help you borrow cash centered on the collateral from the assets. The brand new collateral from property is equal to industry value reduced one the financial. A swelling-contribution financing allows you to acquire a certain amount and you may pay back they more a specified time period.

It may be difficult to receive property collateral financial that have a credit score in the variety of lower to help you fair (580). With this particular credit rating, acquiring financing is far more hard, but nevertheless it is possible to. That have property Security Financing Credit rating 580 applicant must satisfy numerous requirements. When somebody’s score has reached 580 they’ll be when you look at the good better reputation adjust they before you apply so you can property security lender. Borrowing from the bank can be enhanced if you are paying earlier in the day-due bills, fixing mistakes regarding credit file and you can while making regular repayments on go out.

Creditworthiness is more than only a mathematical score into the a research. Actually property Equity Mortgage Credit score 580 would be swayed by in charge economic decisions and you will a robust credit rating. Domestic guarantee financing and you will credit ratings is closely related. It is crucial that consumers understand this relationship. In case the credit history is low, you have less possibilities. However, Family Collateral Loan Credit rating 580 remain readily available. Household equity financing ensure it is people to borrow cash considering their guarantee regarding the possessions. The fresh new security from inside the a property is going to be calculated because of the deducting the brand new mortgage payment from the market value. A lump-sum loan usually has a flat repayment several months and a fixed amount borrowed.

If you want to qualify for a property Collateral Loan Credit score 580 , you then must be extremely economical. For example performing a budget, getting rid of personal credit card debt and gathering their borrowing. It is vital to alter your monetary condition so you can qualify for a loan.

This will make them finest ready to cash loan Mill Plain, CT accept upcoming home equity funds

If you have a property Equity Loan Credit history 580 , it is unlikely that you can get a property equity distinctive line of borrowing unless your financial knowledge is up to date and you also plan ahead. Although there is actually challenges, it is still possible for individuals to get the currency they wanted and you may improve their creditworthiness. Despite a house Equity Loan Credit history 580, it’s possible to nonetheless accessibility collateral in their home thanks to cautious believed and you can wise currency government. After they get to the economic milestone off owning a home, a lot of people contemplate taking out fully a mortgage up against its collateral. Home collateral funds are used for numerous objectives, not just to pay financial obligation or generate solutions. Credit history is amongst the factors you to establishes whether your can get a house-security mortgage. This guide explores home security loans having a pay attention to borrowing from the bank score.

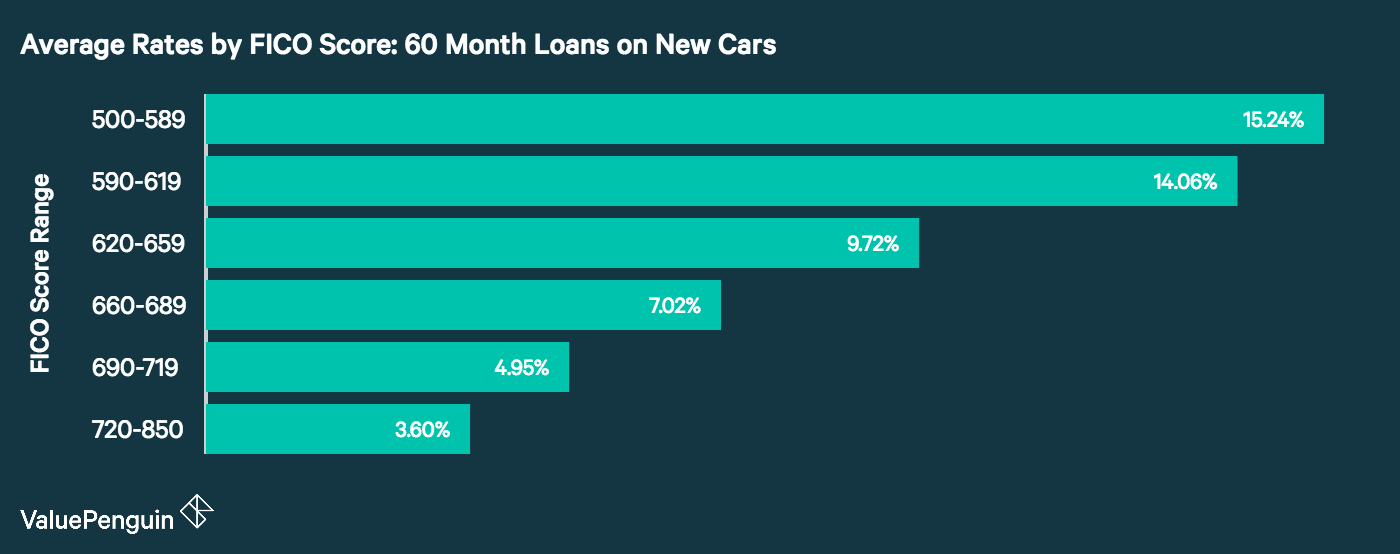

The credit rating of your own debtor is an important basis whenever you are looking at approving that loan. For example household collateral money. When your credit history isn’t an effective, you have got a tougher go out getting that loan that offers advantageous conditions. It may be difficult to get property security type of borrowing in case your credit rating falls about 580s, that is considered fair in order to poor. That it credit rating makes the borrowed funds app procedure harder, but not impossible.

This type of perform could result in increased credit history otherwise finest mortgage terminology

Of a lot requirements need to be met just before a home equity financing normally getting recognized. Allowed potential shall be improved because of the proving what you can do to pay back the borrowed funds, plus track record of making in control economic behavior. Another person’s credit rating shall be increased to help you 580 because of the doing work difficult. Investing bills timely is an excellent way to improve credit. For more information see our very own web site Fantasy Home mortgage or get in touch with us about this amount (972) 2455626.