Без рубрики

Investment Their Home loan: Merchandise and Gift Emails

Whenever you located your loan pre-recognition, anticipate to discover data files having a beneficial conditionally approved mortgage. One position could be on the best way to obtain a present letter. This occurs an individual helps you make your get, generally of the chipping in the advance payment cost.

When someone try working out for you, you need to require brand new financial support well in advance. Deposit they. Allow it to year on your make up over a couple (preferably around three) membership statements. This way, if the mortgage pro asks observe the standard a few months away from lender comments, the money could be nothing new.

However, if the provide import is found on your own latest financial comments, their mortgage expert commonly demand an explanation. Just how performed those funds infusion reach your bank account? What’s the way to obtain the amount of money?

What a present Letter Is always to Have

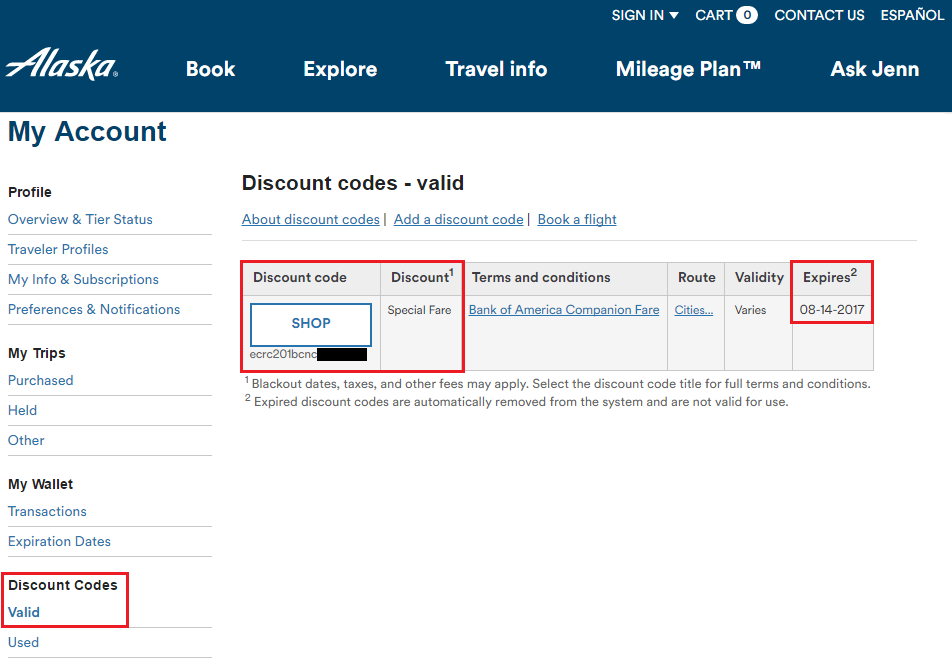

The provide page is an easy, one-web page report having the key details of the cash transfer. Your home loan expert will provide you with a template into the page. Cut financial info: an image of new see and the import in the provide donor’s savings account.

The financial specialist get request every papers tracing the fresh import, and may also inquire about a financial declaration from the donor. Why? The financial institution really wants to see the history of the amount of money inside the account it originated in. It seems that the currency could have been legitimately obtained.

- A subject on top, certainly to provide the new document while the Gift Page.

- New donor’s identity, done target and you can contact number, and you may relationship to the newest debtor. That is most frequently qualified? Any person relevant by blood, wedding, adoption otherwise guardianship, wedding, or home-based relationship. Not any people mixed up in real estate purchase.

- The level of the new present.

- The fresh new target of the house are bought.

- The newest gift donor’s supply of money: title of one’s financial institution; membership amount and you may what sort of account it is; and also the date on which a financial glance at with the was (otherwise would be) transferred to the mortgage applicant’s escrow account.

- This new old signatures of your own current donor and you will domestic client.

Key of all of the: The fresh donor are signing a statement that zero cost, in a choice of currency or properties, is anticipated. The financial institution must be sure (a) you are not whenever a special obligations whenever choosing the cash; and (b) the provide donor has no lienable claim from the property.

There is certainly a common-sense reasons to possess (b). You simply need to imagine such a loan provider to identify they. The lending company, who’s got to cease chance, can potentially think a dispute along side money at some point after closure. Let’s say the brand new disagreement resulted in the one who offered you the bucks and make a claim into the household term? A gift page demonstrates that the brand new donor is one to – and also zero vested demand for the value of the house.

Why a present Page Have to be Truthful

When you have to pay the cash return in the specific later on time, it isn’t a present. This you can try these out new underwriter must count it as loans on your own debt-to-money (DTI) ratio.

Zero strings connected? Then your donor would be to invest in complete a present letter. Towards the bottom, you will see a space for both donor and person to help you certify their comprehending that it is a national crime, having serious punishment, so you’re able to consciously misrepresent their intentions.

Here, a debtor you are going to query just how somebody perform learn. And just how perform someone perhaps charge a good donor otherwise recipient having a federal crime because contract is over?

It does happens. Men and women have work loss, loved ones problems, medical occurrences, or any other events conducive so you’re able to financial setbacks. Specific loans get into home loan standard. Specific residents face property foreclosure otherwise bankruptcy proceeding. Throughout the sad event regarding suit, courts tend to consider papers this new citizen regularly get the home loan. Of course, if misrepresentations have been made, they are going to come to light.

Consult with your home loan professional concerning top brand of financing for your disease, including your intention to utilize gift fund. For a standard tip, the favorite form of loans incorporate this type of requirements:

- Old-fashioned money as a result of Fannie mae and you will Freddie Mac: A present from a member of family is finance the full advance payment to own an initial home. Freddie Mac computer plus lets loan candidate to use present relationships current funds from friends and family members.

- The brand new Federal Casing Management (FHA): Something special of cash is appropriate away from a close relative, connection, manager, friend, or nonprofit company. The money can also be acquired regarding a public organization you to supporting first-time homebuyers otherwise low- in order to average-earnings customers.

- Department regarding Veterans Factors (VA)and you can U.S. Agency off Agriculture (USDA) loans: Va and USDA loans officially don’t require a downpayment. Merchandise and gift characters are still are not allowed to finance down repayments for those orders.

Basically, really mortgage loans accommodate present money to fund a complete down payment into an initial house. Financing laws are stricter to your requests out-of funding qualities.

Specialist tip: Your own financial may also enable you to have fun with current currency having mortgage reserves, when you’re applying for a normal loan. Provide currency past the requirements for the downpayment could be directed to help you supplies within the an enthusiastic FHA loan. Pose a question to your mortgage professional otherwise financing manager having current advice to suit your very own disease.

Taxation Factors to possess Current Donors

If the offering over $fifteen,000 ($29,000 to possess shared filers) to almost any one recipient, brand new donor should declare new present into Inner Revenue Provider. When filing tax returns toward year the fresh current page was signed, the brand new donor would be to use the federal current reporting function to help you statement the new transfer of finance.

The newest donor would not shell out tax into gift currency. However, providing comes with tax implications, no less than written down. Its subtracted regarding the lives gift matter one could possibly get promote income tax-free. Thus, the fresh new donor would like to consult a taxation top-notch getting information.

Several Last Words to your Smart

Once you have the conditional approval, avoid and come up with large deposits into the accounts (like a weird put more than half your own month-to-month income) up to when you romantic on your the possessions. Remember that lenders reexamine their assets in the event the two months go by since they basic reviewed your own two months regarding bank statements. Highest places in the family savings are also causes.

It’s best that you explore a present (and you will something special letter) only when you really need it discover that loan. It’s also best that you comprehend the current letter’s purpose of good lender’s point of view. That it skills helps you steer clear of courtroom troubles. It can also help you earn a final financial acceptance…right on day.