Без рубрики

A case of bankruptcy is also knock doing 2 hundred items from your credit score

The eye pricing for an interest rate immediately following personal bankruptcy will vary, depending on the mortgage in addition to borrower’s credit score.

Interest levels fall and rise, depending on monetary items. As an instance, inside the 2020 and you can 2021, brand new U.S. Government Set aside leftover interest levels historically reasonable. If you’re rates change, the fresh gap amongst the speed having a borrower with high credit score and something that have a low credit rating stays about the same.

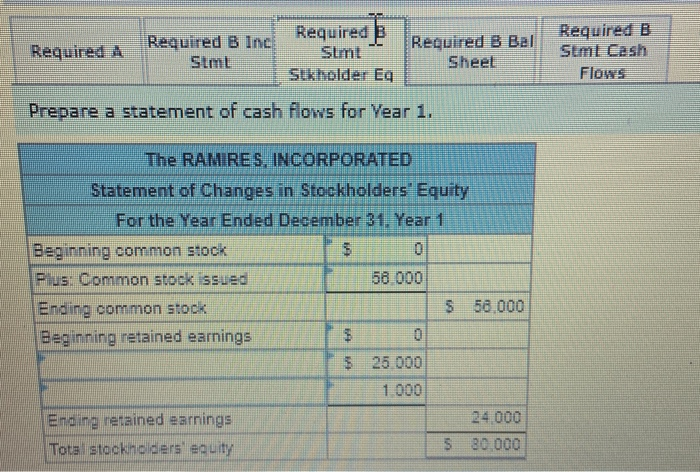

That it chart, exhibiting prices off 2021, measures up interest rates for different type of funds and exactly how they differ with fico scores:

Exactly what are FHA Fund?

FHA financing try mortgages backed by the Government Homes Expert, designed for people who possess problems providing a normal mortgage on account of a woeful credit background or money. FHA funds provides convenient borrowing standards minimizing down costs.

While the You.S. authorities backs new money, credit associations much more ready to render them to individuals with poor credit results, even though the lower your credit score, the newest much harder it may be locate a loan provider.

A borrower which have a FICO rating from 580 can qualify for an enthusiastic FHA mortgage that have a downpayment away from step 3.5% and you can someone with a beneficial 10% downpayment can be meet the requirements that have a 400 rating. The lower the fresh score, the better the pace and harder it may be discover a loan provider. When you are using that have a credit rating below 600 is achievable, less than 2% out of FHA financial individuals had a credit history one low early inside 2021.

Chapter thirteen – Two years in the event the package costs have been made on time and the latest trustee of your bankruptcy proceeding gets an ok.

What exactly are Conventional Financing?

They are not protected from the government, but they normally have the best rates and conditions, which means down monthly premiums. The most used brand of antique mortgage was 31-12 months repaired-speed, and this taken into account 79% from mortgage loans between 2019 and you will 2021, predicated on Freeze Financial Technology.

Antique fund wanted a credit rating out-of 620 or higher. The better the get, the greater the brand new words. One of the largest benefits is the fact a deposit out of 20% setting it’s not necessary to pay individual home loan insurance rates, that can create plenty to a mortgage.

Even though you cannot set-out 20% during the closing, as equity in the home are at 20%, this new PMI is actually fell. Having an FHA mortgage, it never ever drops, along with to spend a-one-date up-side advanced of just one.75% of your foot level of the mortgage.

- A bankruptcy proceeding Couple of years once launch go out

- Part 13 Couple of years. In case the case is actually disregarded, hence happens when the person filing for bankruptcy will not follow the plan, its few years.

Just what are Virtual assistant Fund?

The fresh Va mortgage program, given from the U.S. Agency regarding Experts Issues, now offers reasonable-costs money to help you veterans and you will effective armed forces team. Qualified individuals aren’t needed to build off money, a few of the settlement costs is forgiven and you will consumers lack to spend mortgage insurance.

There are lots of criteria when you have gone through good bankruptcy whenever they want to get good Virtual assistant loan.

Chapter 7

- Zero late costs given that bankruptcy submitting;

- No derogatory borrowing (collections) just like the bankruptcy;

- A minimum average credit history regarding 530-640 (predicated on in which the borrower lifestyle);

- Two year waiting months just after discharge.

Section 13

- A minimum 12 months waiting from bankruptcy proceeding initiation day;

- An appropriate results of your bankruptcy proceeding repayment bundle;

- No late costs pursuing the date of one’s 341 (fulfilling regarding loan providers and you may personal loan companies Clearview WV personal bankruptcy trustee);