Без рубрики

5 reasons to envision refinancing your property loan

Remember those occasions your spent contrasting home loans before buying your domestic or investment property? You’re enthusiastic about the new following pick and you can trawled the internet to find the best deal, otherwise invested period which have a mortgage broker determining the perfect home loan for your items.

That may have been a short while ago today. Your circumstances may have changed and, like your strength, smartphone and you may sites costs, it’s a good idea giving your home mortgage a health consider.

Its advantageous to have a look at your home loan annually and you will, if it’s not suiting your needs, consider refinancing. You will need to thought people costs or charge that may incorporate in the event you split your existing financing package before it finishes in the event.

payday cash advance loans Wyoming

1. You could potentially lower your money

Refinancing your residence mortgage may unlock a reduced rate of interest, meaning you could potentially shell out faster notice over the lifetime of their loan. This may lower your costs and place extra money into the wallet.

Believe most of the financing masters and charge when you compare interest levels and take any attention you reduced so far under consideration when figuring if you’ll save cash in tomorrow.

dos. You will be in a position to reorganise the money you owe to the an individual mortgage

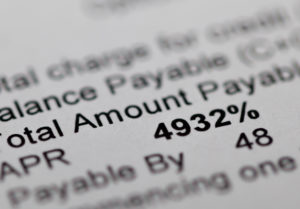

If you’re holding onto charge card and you may/or personal bank loan debts, as well as your financial, you may also imagine going the bills to each other. Its called ‘debt consolidation’ and you will works on the idea you to definitely domestic mortgage rates should be less than some credit card or consumer loan costs.

3ing toward stop out-of a fixed identity?

Introductory fixed rates words can be really enticing when you first get a mortgage. But not, the pace our home financing non-payments so you can following introductory period may not be as the aggressive.

Should your fixed interest identity is nearly upwards, it is an effective need to consider refinancing your house mortgage. Looking around for a special contract to protected yet another price otherwise change to an aggressive adjustable rate will save you many.

cuatro. Change the period of your loan period

In the event your money and you may expenditures enjoys altered, it could be a great time to take on refinancing your home financing by looking to alter the period of your loan several months.

Stretching the loan several months can reduce your own monthly repayments today; but may charge a fee moreover living of your mortgage. Then it a useful solution in the event that cashflow can be your priority now. Reducing the life span of financing will get raise your money today but may also potentially save you plenty within the attract across the life of the loan.

Each other possibilities keeps its benefits and drawbacks so be sure to research your facts and you may speak to your lender regarding the possibilities.

5. Replace your lifestyle having brand new home mortgage benefits

Refinancing to a home loan having benefits, like our very own Qudos Financial Qantas Issues Financial otherwise Discount Mortgage (Value Package)*, get unlock positives that may save a little money and you may increase your chosen lifestyle. Credit card percentage waivers, insurance policies savings and you may complimentary financial considered will save you money and you may enhance your financial studies. Making Qantas Points may help you just take you to definitely escape you have been longing for. Plan mortgage brokers always interest a yearly percentage, so it’s crucial that you think about this whenever choosing if the added benefits is suitable for you.

Think about what you really need and need from your own home financing and you may opinion the benefits of more factors to get your dream financing.

If you would like some assistance reviewing your existing financial, contact us into the 1300 747 747 to talk to a home loan specialists.