Без рубрики

This is exactly confusing if you find yourself seeking the ideal financial costs

We make stress out from the mortgage review processes for the website subscribers to make it better to find a very good home financing into the Quarterly report. Along with forty lenders and you may 100’s of products available, selecting the right manager filled otherwise money financing is done easy with your app that links to the banks.

Sharing the brand new expectations of your own financial predicament for the brand new small and overall, enables us locate a definite picture of your needs so you’re able to dump charges and costs and loan providers home loan insurance coverage (LMI) can cost you.

Included in our very own totally free solution, we will offer a complete home loan assessment within the Questionnaire outlining an educated financial costs and you may analysis prices. We could including identify your own real repayments having fun with an installment calculator or take into account any additional money and you may latest amount borrowed in the event the utilising a counterbalance account.

When determining your credit capacity and loan amount, we will establish how the financial calculates your capability to settle the borrowed funds if you implement, assuming requisite, indicates how handmade cards in addition to their constraints can increase or drop off the borrowing from the bank strength.

Greatest home loan cost

It’s easy to assume that the best home loan costs would be the of these into lowest rate of interest, but that’s not necessarily your situation. Occasionally, an amazingly low interest come with fees and you may costs and you can lender constraints that make the item far more expensiveparison pricing reveal the actual rate of interest but will consumers was claimed more by the the fresh new said rate of interest and do not cause of one other aspects you to add to the loan payments. Specific loan providers create margin to their rates of the month-to-month charges and you will fees, charges for extra money, counterbalance account and you can redraw business. We provide an entire unit assessment with every invisible charges and you will charge so you’re able to compare mortgage brokers within the Questionnaire precisely.

To invest in In the Quarterly report

Brand new Lexington loans Sydney assets market changed somewhat in the last a couple ages, especially in aspects of the Quarterly report CBD, the newest North Shore, West Suburbs and North Suburbs. Entering this new Quarterly report assets market should be difficult but indeed there will always be possibilities on exterior suburbs off Sydney. Customers should stop suburbs in which there’s a glut away from accommodations because loan providers examine these as highest-exposure, for example from the large cuatro banks. High-exposure suburbs might need deposits all the way to 31% of individuals, therefore it is important to speak with a questionnaire mortgage broker before doing your home browse. Given Sydney’s large property opinions, obtaining the reduced financing costs and you may as well as additional features instance an counterbalance membership otherwise redraw institution are essential to make certain you minimise costs and you will fees but also, lower the loan as fast as possible.

Financial CALCULATOR

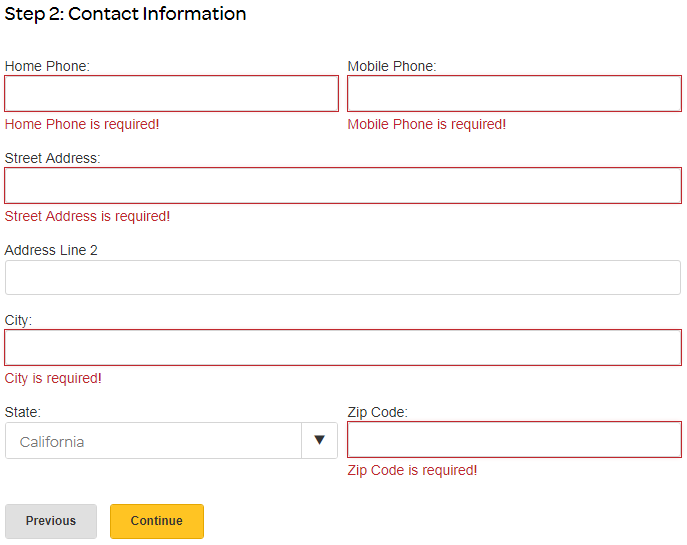

Probably one of the most complicated parts of securing home financing is actually workouts exactly how much you could potentially acquire and you can just what loan payments might be. Thanks to this a general on the internet mortgage calculator will provide homebuyers wrong figures and just why working with a different financial agent in Questionnaire is key to delivering exact pointers. When figuring their borrowing from the bank ability and mortgage payments, we definitely are able to repay the borrowed funds and that you never offer your borrowings outside the budgets.

Mortgage Device Research

If you know simply how much you can borrow, the next thing is evaluate mortgage brokers to obtain the best home loan rates. That have the means to access more forty some other lenders and you will 100’s of different home loans, Perfect Equity’s program brings data directly from lenders to make certain we obtain the fresh mortgage products and review pricing to have you to select from.