Без рубрики

The new report mostly includes your credit history, most recent balances, and you can delinquent expense

You might will decrease your home mortgage speed by buying disregard circumstances. You to definitely write off section is equivalent to step one% of the amount borrowed. You to definitely disregard section can reduce their 29-season Virtual assistant mortgage price by the 0.125%.

Identity Insurance fee protects the fresh homebuyer additionally the lending company out of getting kept liable for difficulties such as for example unpaid mortgages, liens, and you can legal judgments overlooked regarding 1st name lookup after possessions ownership are transmitted.

Credit file fee talks about the expense of carrying out a credit assessment in your stead. Which fee can differ depending on how much info is questioned.

Assessment payment is actually paid off so you’re able to an excellent Va-acknowledged appraiser to imagine the value of the property, confirm that our home try flow-for the ready, and you may meets the fresh Experts Affairs’ minimal property requirements. That it commission utilizes your local area and kind of assets.

App Processes

Good pre-approval offers a very clear idea of just how much domestic you can afford. By the to provide a great pre-recognition letter, your excel to manufacturers and real estate professionals because a good big consumer.

The mortgage user find out regarding the wanted amount borrowed, employment background, army services, and you will social security matter to own a hard credit check. Should your funds here are some, you’ll be able to start the new pre-acceptance procedure and get an on-line account from the My personal Pros Joined webpage. This on line program allows you to publish, indication documents electronically, and screen the loan application processes.

A great pre-acceptance is actually an even more inside-depth verification of the economic and you may borrowing from the bank guidance. You’ll want to publish a national-provided ID, DD 214 to have pros, an announcement off services when you’re on active obligation, paystubs, couple of years away from W-2s, a recently available financial declaration, or other files given that questioned. Once you have got your own pre-recognition letter, you are able to possess home hunting.

Through Pros Joined Realty, Veterans Joined links homeowners that have several experienced and you may experienced real estate agents. Such gurus comprehend the needs off armed forces homebuyers and will assist them rating a property that meets Virtual assistant fund. Va financing try on acquisition of primary residencies. You can purchase doing a several-device home with an excellent Va loan if you intend to live within loans in Colona the systems. Your own potential household are who is fit and you may meet with the minimal assets criteria.

Once you have found your chosen home, you’ll need to place a deal and also it around bargain. New price ought to include contingencies so you’re able to withdraw in the get agreement in the event the something you should never wade as expected as opposed to breach out of bargain. Using comparables, their broker will allow you to decide on a reasonable purchase price centered on economy requirements.

Just after you are significantly less than package, you will be assigned opportunities to-do on your own Experts United Webpage. The fresh new jobs appear as the To-do. They are the records you will have to submit to the loan administrator. You have a final check of the records of the a keen underwriter. A Virtual assistant-acknowledged appraiser will additionally measure the property’s market value to be sure your final price suits definitely along with other comparable attributes on the industry and property match the minimum standards as needed of the the fresh agencies.

You are getting a closing disclosure means before the last closure. That it file sumount, financing title, interest, and you may a list of the latest settlement costs. The three-big date window brings a borrower time and energy to review the borrowed funds terminology and you may find any clarifications before the financing was signed. If a service associate can’t sit-in a closing, Experts Joined allows a digital fuel off attorney.

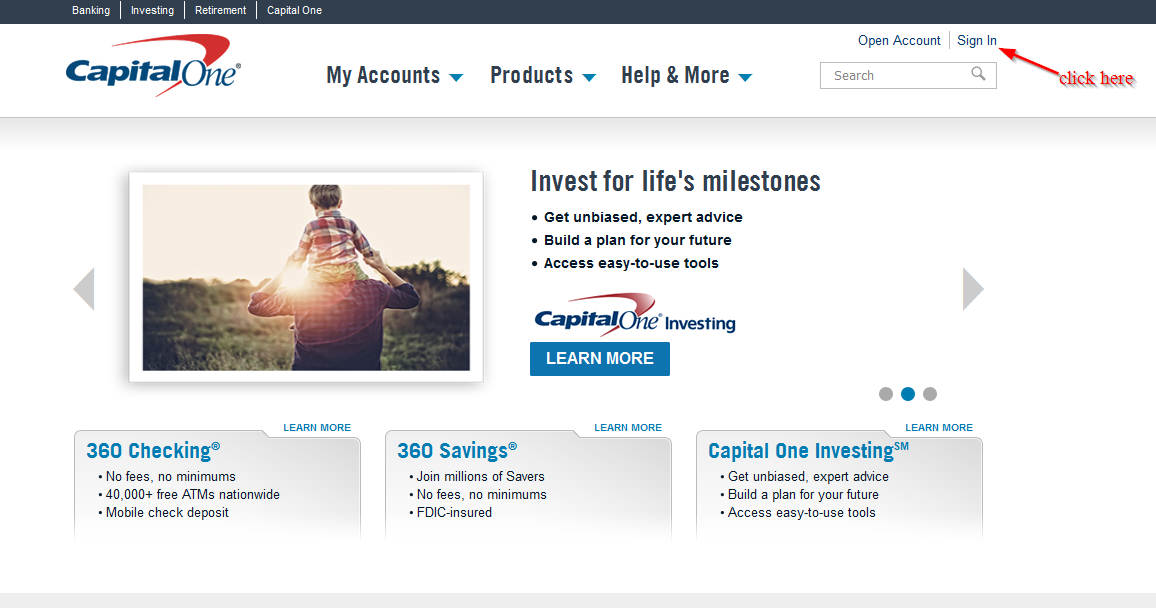

In the Pros Joined, you could begin the pre-qualification processes on line or keep in touch with a loan associate on the mobile phone

With a great Va improve re-finance, you could decrease your monthly home loan rates. As well, an effective Va IRRL needs reduced records given that zero borrowing from the bank underwriting, income confirmation, otherwise appraisal are required normally. You happen to be eligible for Virtual assistant IRRRL in the event the:

Loan providers fees an origination percentage to cover administrative can cost you off the loan. The price essentially amounts to one% of one’s amount borrowed.