Без рубрики

HELOC Vs Refinance: That is Best for you?

Topics: Budgeting Family Tips Mortgages

Once you have built up certain collateral in your home, you happen to be thinking concerning the most practical way to view brand new loans in order to over home improvements, carry on an aspiration trips, consolidate personal debt, otherwise achieve a different sort of objective.

An effective HELOC also offers a continuous way to obtain borrowing which is often named a moment mortgage since it is another financing. In contrast, a funds-away re-finance mode you take away a new financial to help you replace your existing financial. Read on to compare a beneficial HELOC compared to dollars-aside refinance.

CASH-Aside Re-finance Against HELOC Overview

Both property checking account for bad credit collateral personal line of credit (HELOC) and you can a cash-out mortgage refinance need you to has some security of your property one which just availableness one loans. You might estimate how much guarantee you’ve got of the subtracting their home loan balance about newest value of your house.

Your property serves as equity for both a HELOC and money-out re-finance hence form you can acquire lower pricing than to possess an enthusiastic unsecured unsecured loan or credit card. You can also have the ability to borrow way more fund than simply can be found through other sort of financing.

About a money-out re-finance against HELOC, remember that you will end up at risk of dropping your home if you don’t pay the fund back. That is why you need the cash to pay for extreme factors on the so you’re able to-carry out number and not their normal costs.

What exactly is Good HELOC?

A house collateral credit line, commonly referred to as a good HELOC, try a line of credit enabling you to utilize the fresh guarantee of your house to access that money. The same as credit cards, you could potentially borrow funds around an appartment credit limit throughout the brand new mark months or set time period limit.

What’s A finances-Out Refinance?

An earnings-aside re-finance is yet another cure for control your current family security. By firmly taking away a bigger mortgage on your own house and you will paying from the newest home loan, you could pocket the difference, enabling you to availability that cash.

How can i Use the Money?

- Consolidate most other loans

- Pay-off other financial obligation, for example higher-interest handmade cards

- Do-it-yourself programs, renovations, and you can repairs

- Vacations otherwise wedding parties

- Scientific expenses

When you find yourself these two solutions will bring you money you you prefer, you are able to consider the advantages and disadvantages to greatly help you’ve decided if or not an effective HELOC or a profit-out refinance was a much better fit for your.

HELOC: Positives and negatives

An effective HELOC allows you to borrow money since you need all of them, that’s especially helpful in the event the funds was not finalized or if you want to utilize the finance getting a selection of aim. Also, you have to pay desire to your part of loans make use of.

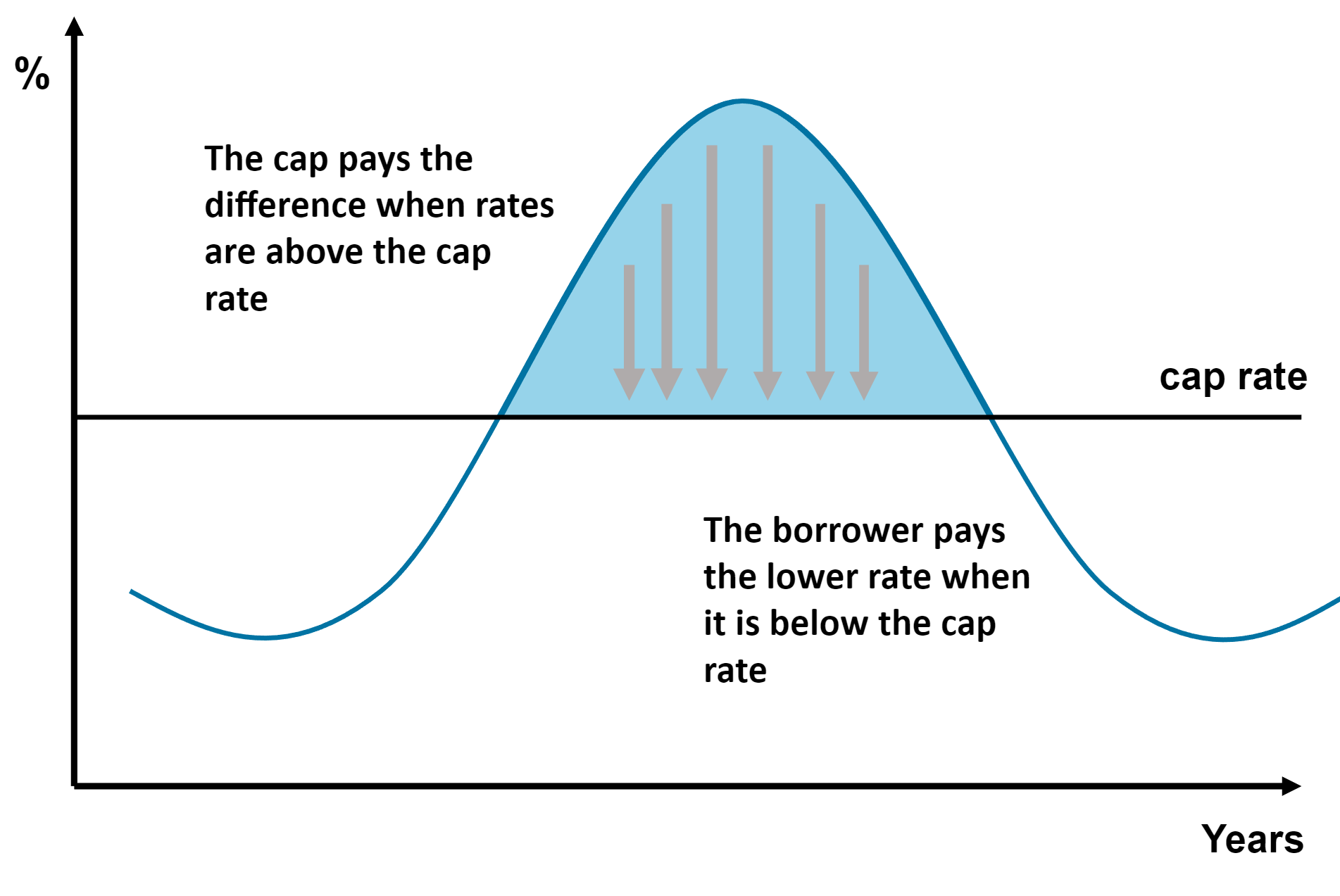

However, you’ll want to pay the fresh HELOC and their newest homeloan payment, that will make you with several payments getting accountable for. While doing so, be aware that of several HELOCs has actually an introductory rate of interest which will increase to a new, adjustable rates then months.

CASH-Out Refinance: Positives and negatives

Once you had opted that have a funds-away refinance, you have made a different mortgage to restore their old home loan, and you might have a single homeloan payment for an alternative matter. Which have one payment can make cost management simple, and you might receive the a lot more money from the guarantee the at the immediately following during the a lump sum.

Yet not, there are constraints to cash-aside refinancing (known as a profit-away refi). Because you take out another type of home loan, you can get an alternative rates on your mortgage created toward what exactly is available today. When the rates are greater than after you took out your completely new financial, it’s also possible to shell out a great deal more interest each month and much more full attract across the longevity of this new loan.