Без рубрики

Independent Contractor Accounting Toronto BBS Accounting CPA

You might get sick or a natural disaster occurs and you are not be able to complete the work assigned. Even a change in the demand for your service can be impacted by changing trends. This is a smart plan regardless, but especially if you are classified as a business. Any audit that may occur is instantly easier due to the separation of these accounts. You have a record of your business’ financial transactions and can prove it. If your personal expenses are in the same account, your claims could be scrutinized.

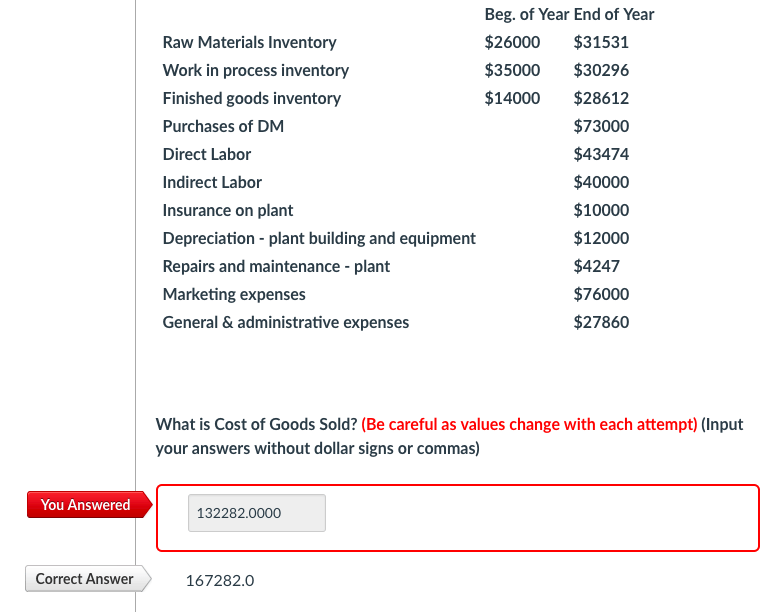

You can calculate your net profit or loss by subtracting the business expenses from your income, which contractors may omit when estimating taxes. If your income exceeds your business expenses, you can report the net profit on IRS 1040 or 1040SR form; or for a net loss, the amount can be deducted from your gross income. Remember, the Internal Revenue Service limits how much loss independent contractors can deduct from their gross income. Self-employed or not, you need to monitor what’s going in and out of your bank accounts. Our bookkeepers will develop an easy framework when setting up your books. There are a lot of business expenses that independent contractors need to keep track of in order to pay the least possible income tax.

If you do not use the funds they will roll over, earning pre-tax interest, which then can be applied to future healthcare costs. This is intended to be a basic outline not a complete discussion of what being an independent contractor is. This is meant as a starting point for you to understand how to run your business. You can find more information in IRS publications #535, #463 and #17. These and other publications are available over the internet or can be picked up at the Van Nuys IRS office. Please seek education and professional help with your questions from your local school, lawyer, insurance broker and tax professional.

Small Business Administration Simplifies PPP Forgiveness Process

You will also forgo employee benefits like the Occupational Safety & Health Act (OSHA), the Fair Labor Standards Act (FLSA), and Title VII of the Civil Rights Act. Cook CPA is committed to providing consulting, accounting, tax and auditing services that distinguish our common sense, uncommon service approach from any other CPA firms. We do so by utilizing technology to its fullest capabilities, taking time to understand and analyze a business’s needs, long-term goals, and objectives to personalize each and every interaction.

Without a systematic bookkeeping system in place, there’s no way you would ever keep track of all of these items. You are your own boss, you can set your own hours, and you have more freedom than working as an employee where everything is dictated by someone else. When deciding to bring in a professional or not, you may ask yourself if you can afford to. However, what you should be asking is, can you afford to not bring in a professional to help with such important information. If you do not have the documentation, you cannot back up your costs if there is an audit.

Browse Articles by Month

Because while the law requires we pay taxes, there is no reason to leave a tip. Being a bookkeeper for yourself and having an efficient bookkeeping system in place is essential if you’re an independent contractor. If you’re a freelancer and want simple accounting with a focus on your needs, FreshBooks is a solid choice. If you have more than five clients, you’ll need the Plus version, but all of the plan tiers are reasonably priced. It is pretty likely that you became a contractor because you have a skill that matches a need in the business world or perhaps, you didn’t like the 8-5 grind everyday and were looking for more freedom in your workday. No matter your reason, your goal is to become as successful as possible to maximize your income and profit.

You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). What matters is that the employer has the legal right to control the details of how the services are performed. Financial Control Consider how much right the worker has to control the economic aspects of their job. Independent contractors are self-employed so they have business risk. They have to generate enough revenue to cover expenses to avoid a loss. Whereas, employees are usually paid a relatively predictable or consistent amount and don’t incur the kind of expenses that could result in a loss because they are not operating a business.

Our team will file your tax return based on your books, records and any additional information you provide. Our tax professionals decipher between all of your expenses and determine what tax is deductible or not. We then combine all of your information and prepare all necessary forms and schedules. Our accounting services are designed and centered around your type of business. Whether you’re a business owner with multiple team members or are a sole proprietor, we specialize in servicing independent contractors with all of your accounting needs.

Best Accounting Apps for Independent Contractors

You can use Receipt Bank which we provide for free or Quickbooks to capture and import all receipts for an Audit Trail. We service clients throughout Virginia and Washington, D.C., including Arlington, Fairfax, Alexandria and Falls Church, VA. This is not a total discussion covering everything there is to know. It is an outline of definitions and the answers to the most commonly asked questions about taxes and requirements for being self-employed. → Any income you received or earned is not considered salary or wages.

Halifax accountant pleads guilty to defrauding Homburg of $1.5 million – Saltwire

Halifax accountant pleads guilty to defrauding Homburg of $1.5 million.

Posted: Tue, 02 May 2023 07:00:00 GMT [source]

Omitting expense deductibles on estimated tax forms each quarter is common among independent contractors, which can easily result in overpayments. Although it is possible to recoup the payment in excess when filing your federal income tax return, you should reserve that cash for other use. For the self-employed filing taxes next year for the first time for earnings from 2022, you can consider your tax liabilities by estimating the income amount you are expecting. Here is everything you need to learn about self-employment taxes for the self-employed, including how independent contractors pay taxes, the tax rate, and tax-deductible benefits. Proactively Estimate to Save

The number one mistake independent contractors make is failing to plan for their full yearly tax burden.

CA Do Not Sell or Share My Personal Information

Provided you comply with the IRS rules (ask your accountant!) this can help reduce your tax burden when working on projects that require long-distance travel. After we’re done with the steps above, it’s time to double check the figures. To ensure accuracy on your financial statements and ultimately your tax return, we will reconcile your accounts. As is always recommended when drawing up any kind of legal document, both parties can be well served to consult a qualified attorney with experience in independent contractor contracts.

Whereas the employer is responsible for withholding taxes for each employee, the Internal Revenue Service requires the self-employed to pay an independent contractor tax. No one looks forward to tax season, even (especially!?) accountants. But tax requirements and reporting burdens may be increasing if you’re one of the 16 million independent contractors working today. Independent Contractor Tax Advisors is a licensed CPA firm that provides accounting services and tax advice for contractors, consultants and other self-employed clients across the U.S. For a low, fixed monthly cost, we use sophisticated strategies to legally minimize the taxes of independent contractors and freelancers while improving bookkeeping, streamlining payroll, and reducing IRS audit risk. Our clients love us because we simplify their lives and put more money in their pockets.

The Benefits and Disadvantages of Using a ‘Password Vault’

Independent contractors, since they are the sole business owner, are responsible for everything that goes on in the business. As far as keeping track of expenses, the IRS considers a business expense as anything that is necessary and ordinary to the business. Although customer service reviews are mostly positive, some FreshBooks users report that they’ve been double charged, and customer support is not always responsive to these issues. Third-party customer reviews point to significant problems reaching customer service and getting resolutions to their problems. Financial reports can prepare your business for the future by looking at your past and present to prepare you for future decisions.

He is a nationally recognized speaker on a variety of tax topics offered for continuing education for CPAs and financial planners and has authored several publications and articles. We will send you a kick-off email with important information and what files to send us to set up the software and set up CRA representation. Our bookkeeping contracts are renewed monthly, allowing you the flexibility to cancel any time. The DOL reinforces that there is no single test that determines a workers status.

At the end of the year, the total taxable income must be proven with the W-2 form filed before the annual deadline in April. However, whether these people are independent contractors or employees depends on the facts in each case. The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how Accountant for independent contractor it will be done. Companies that work with accountants, particularly accounting and bookkeeping firms, must check if their accountants are licensed in California. If not, these employers will be subject to the ABC test instead of the Borello test. When you sign on to perform an accounting or bookkeeping job, it’s important that you establish a clear working relationship with the firm that hired you.

Setting the record straight on Boox Vs HMRC, by The App … – Contractor UK

Setting the record straight on Boox Vs HMRC, by The App ….

Posted: Wed, 22 Feb 2023 08:00:00 GMT [source]

Money used from your personal account will be considered a shareholder loan and you can be paid back for it. However, it is important not to use your business account to pay for personal expenses. Get the education and resources you need to make informed business decisions and establish quality business processes, including bookkeeping and cash management tasks.

For tax purposes, independent contractors are either considered a single-member limited liability company (LLC) or a sole proprietor. We chose QuickBooks because we believe it has the most features, ease-of-use, and pricing that most independent contractors will need. But every contractor is different, so one of the other accounting apps on our list may fit your needs better. You will want to open a bank account specifically as an independent contractor business. This will help you separate your financial status from your businesses. In the case of an audit, it is helpful to have everything separate, primarily if you classify yourself as a business.

As a contractor, your wages will be heavily scrutinized and it is best to have the most accurate snapshot of your estimated tax payment to avoid being hit with a larger than expected tax liability. People that work for a business are usually classified as employees. This means the business owner is responsible for withholding and reporting a certain portion of the wages earned by the employee. These withholding’s are the employees tax liability, social security, medicare and unemployment taxes in each pay check.

- Accurate accounting for independent contractors can be complicated.

- Some workers may prefer to be classified as independent contractors because employees are not permitted to deduct unreimbursed employment expenses on their personal tax returns.

- Being a bookkeeper for yourself and having an efficient bookkeeping system in place is essential if you’re an independent contractor.

- This blog article is not intended to be the rendering of legal, accounting, tax advice, or other professional services.

Many states use some form of an “ABC test” to aid businesses in the classification of a worker. California has a notable adoption of an ABC test that garnered mainstream attention in the state’s Supreme Court ruling in April 2018 in the case of Dynamex Operations West, Inc., v. Superior Court. The ruling established that companies must use a three-pronged test to determine how to classify workers. This test assumes that workers are employees unless the company that hires them can prove otherwise. In a nutshell, employees receive a Form W-2, Wage and Tax Statement, and are taxed on this income at the federal and state levels.

Businesses can be subject to back taxes, interest and penalties if they treat someone as an employee yet pay them as an independent contractor. Based in Arlington, VA our CPA firm is a full service accounting firm, specializing in Tax Services, CFO Consulting and Bookkeeping services. Our CPA firm prides itself on its technological advantages and innovative company culture to provide better service to its clients and partners to help them grow their small business and reach their professional goals. Since independent contractors do not automatically have taxes withheld from their paychecks, they must pay self-employment taxes on a quarterly basis. As a business owner, it’s important to regulate your processes, especially if you are outsourcing accounting tasks. Having a number of independent contractors can pose a huge problem when protocols are not in place to make sure they are properly regulated.